Florida Hurricane Damage Insurance Claims Lawyers

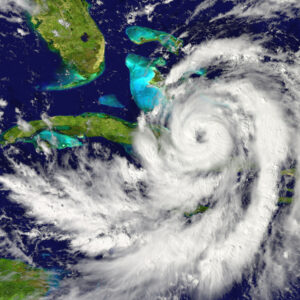

Huge hurricane approaching Florida in America

Smith & Vanture are Florida hurricane damage insurance claims lawyers who can help you if your hurricane damage claim was denied, delayed, or underpaid. In the aftermath of a major hurricane, like hurricane Ian, insurance companies may attempt to limit their liability by underpaying a claim, failing to properly investigate a claim, or claiming that damage was due to storm events that are not covered by your insurance policy. Hurricane damage insurance claims can get complicated. Standard homeowner’s insurance policies may not cover flood damage. Yet, if your home suffered water damage, wind damage, and flood damage, your insurance company might try to claim that wind damage or water damage or another type of covered damage was due to flood damage or a cause that is uncovered. This can lead to an underpaid claim, a denied claim, or delayed claim.

In the aftermath of a hurricane, homeowners could face thousands of dollars of repairs. People who purchase homeowner’s insurance do so to protect their finances and homes from these types of situations. Unfortunately, in the aftermath of a major hurricane, homeowners might find their claims denied, delayed, or underpaid. Insurance companies may be overwhelmed with claims after a hurricane, but this doesn’t give them an excuse to improperly adjust or investigate your claim within the legal timeframes.

If your home was damaged in hurricane Ian, or if you are still trying to receive a settlement for an earlier hurricane, the Florida hurricane damage insurance claims lawyers at Smith & Vanture may be able to help you. Our lawyers can review the fine print of your policy, estimate the value of your damages, and fight to hold your insurance company accountable.

What to do If Your Homeowner’s Insurance Claim Is Undervalued or Underpaid

A Florida hurricane insurance claims lawyer at Smith & Vanture may be able to help you if your hurricane homeowner’s insurance claim was undervalued or underpaid. A lack of proper documentation of damages or evidence is one of the leading reasons why claims are underpaid or undervalued. If you believe your claim was undervalued or underpaid, you may want to review the documentation you submitted to your insurance company. Did you submit photos of damage? Did you submit repair estimates? Did you submit videos of damage, or a walk-through of damaged areas of your home. Did you submit receipts for damaged property or furniture?

If you re-submit your claim with this added evidence, and your claim is still denied, you may want to speak to a Florida hurricane insurance claims lawyer at Smith & Vanture. Our lawyer can help you with the following:

- A Florida hurricane insurance claim lawyer at Smith & Vanture can review the evidence you submitted to your insurance adjuster and help you put together a stronger package of evidence. We can help you get new, more detailed estimates from licensed contractors, submit clear photos documenting damage, and help you find ways to support your claim if you don’t have receipts.

- Smith & Vanture are Florida hurricane insurance claims lawyers who can also help you get an independent adjuster to estimate your damages and submit this information to your insurance company. Sometimes insurance companies might try to reduce their liability by claiming that damage occurred due to causes that are not covered under your policy. An independent adjuster can look closely at damages and potentially dispute these claims.

- A hurricane insurance claim lawyer in Florida at Smith & Vanture can take the time to negotiate with your insurance company. We can find out why your claim has been underpaid or undervalued, and fight to help you get a better settlement. Insurance companies might be more willing to work with individuals who have hired a lawyer especially if they know the lawyer is willing to take them to court for underpayment or bad faith. In many cases, a Florida hurricane insurance claim lawyer at Smith & Vanture can negotiate with insurance adjusters, so that you don’t have to take your case to court.

These are just some ways a hurricane insurance claim lawyer in Florida at Smith & Vanture can help you. If you are facing challenges getting a proper settlement after a storm, reach out to Smith & Vanture today. We are here to help.

What You Need to Understand About Hurricane Insurance Claims

When making a hurricane claim, there are some things you might want to keep in mind. Special provisions and exclusions can apply for certain types of hurricane insurance claims. Understanding the limitations of your policy before you appeal a denied or underpaid claim can help prevent a great deal of confusion. Here are some things to keep in mind.

- Standard homeowner’s insurance coverage doesn’t cover flood damage. Flood damage must be purchased separately. If your home was damaged due to flooding, you may have to take special pains to differentiate water damage, wind damage, from non-covered flood damage. Some insurance policies might exclude all water damage claims if flooding was an issue. Others may differentiate between different types of water damage but determining the source of damage and showing evidence for this will be an essential part of your insurance claim. The hurricane damage claims lawyers in Florida at Smith & Vanture can help you with your claim.

- Hurricane damage claims may have higher deductibles. Every policy is different, but it is important to read the fine print of your policy carefully. The deductible is the amount of money you need to pay out of pocket before your coverage takes effect. If your home was damaged due to high winds or wind-driven rain, you may face a higher deductible for this kind of damage.

- If you fail to make temporary repairs, you could be liable for any damages that happen after the hurricane. Was your roof damaged in the hurricane? Were windows broken? You may need to put a tarp up or board up the windows to prevent further damage. Was your home exposed to the elements or unlivable after a storm? You may need to shut off the power and water to prevent further losses or move undamaged furniture and household goods into storage. To reduce their liability sometimes insurance companies might claim that damage happened after a storm. Sometimes damage did occur after the storm, but homeowners were unable to get to their homes due to destroyed bridges or unsafe conditions. If your insurance company is reducing your claim amount because they are claiming negligence, a hurricane damage claim lawyer in Florida at Smith & Vanture may be able to help you.

- If you need to rebuild, your insurance may not cover the costs to rebuild if building codes have changed. In recent years, Florida’s building codes have changed to require new construction projects to be hurricane safe. These new building codes may require that structures be built with stronger materials, hurricane safe design, and that windows be adequately shuttered or built to withstand high winds. If your home was built at a time before these building codes were in place, the cost to rebuild now might be higher, because you may require more modern windows, and sturdier materials. Insurance policies may have certain provisions to put some money toward paying for these improvements. It can be helpful to have a hurricane damage claim lawyer in Florida at Smith & Vanture to help you should your insurance claim become complicated if you need to rebuild.

These are just some of the unique issues that can arise with a hurricane insurance claim. A hurricane damage claim lawyer in Florida at Smith & Vanture can help you navigate the unique challenges that can arise when a claim is underpaid or undervalued or denied. If you have questions about your rights, reach out to Smith & Vanture today.

Contact a Hurricane Damage Claim Lawyer in Florida

If you are having trouble with your hurricane damage insurance claim, the hurricane damage claim lawyers in Florida at Smith & Vanture are here to help you. There are many unique issues that can arise with a hurricane insurance claim. You don’t need to navigate the claim process alone. Smith & Vanture are here to help.