Venice, Florida Insurance Claims Lawyers

The insurance claims lawyer in Venice, Florida at Smith & Vanture can help you if your homeowner’s insurance claim was underpaid or denied after a storm or natural disaster. If your home was damaged, you, like many homeowners, might find yourself struggling to settle your homeowner’s insurance claim or get clear answers from your insurance adjuster. Sometimes the answer you receive is not the one you want: it’s a settlement that’s too low, or an outright denial. Homeowner’s insurance companies might try to reduce their liability by failing to include certain damages in your settlement, by improperly applying exclusions, by improperly calculating depreciation, by failing to properly explain your coverage, or by acting in bad faith. Some insurance claims can get very complicated. Homeowners aren’t insurance adjusters. Ultimately insurance adjusters might try to take advantage of loopholes to offer the lowest possible settlement. When it comes to insurance claims there are many gray areas. A Venice, Florida insurance claims lawyer at Smith & Vanture may be able to help you.

The insurance claims lawyer in Venice, Florida at Smith & Vanture can help you if your homeowner’s insurance claim was underpaid or denied after a storm or natural disaster. If your home was damaged, you, like many homeowners, might find yourself struggling to settle your homeowner’s insurance claim or get clear answers from your insurance adjuster. Sometimes the answer you receive is not the one you want: it’s a settlement that’s too low, or an outright denial. Homeowner’s insurance companies might try to reduce their liability by failing to include certain damages in your settlement, by improperly applying exclusions, by improperly calculating depreciation, by failing to properly explain your coverage, or by acting in bad faith. Some insurance claims can get very complicated. Homeowners aren’t insurance adjusters. Ultimately insurance adjusters might try to take advantage of loopholes to offer the lowest possible settlement. When it comes to insurance claims there are many gray areas. A Venice, Florida insurance claims lawyer at Smith & Vanture may be able to help you.

The good news is that you don’t have to navigate the insurance claim process alone. The Venice, Florida insurance claims lawyer at Smith & Vanture are here to help you every step of the way. We can read the fine print of your policy, help you understand what is and isn’t covered by your insurance company, hire a private insurance adjuster to investigate your claim if needed, and fight to help you get the settlement you may deserve.

How a Homeowner’s Insurance Claim Denial Lawyer in Venice, Florida Can Help You

Insurance adjusters have an advantage in the homeowner’s insurance claim process. Not only is it their job to understand your policy inside and out, but they also handle many claims every year. Insurance adjusters understand the areas of a claim where there is room for negotiation, and they may offer you less than you might deserve. They understand the methods of calculating a claim that can save the insurance company money. For a homeowner, on the other hand, this might be the first time you’ve ever had to make a claim, and you may not have read the fine print of your policy.

In the aftermath of a storm, you might be eager to repair your home, and may be tempted to accept the initial settlement you are offered, not realizing you might be entitled to receive more. A Venice, Florida homeowner’s insurance claim denial lawyer at Smith & Vanture may be able to help you. Contact our homeowner’s insurance claim denial lawyers in Venice, Florida today to review your settlement, review your proof of loss forms, and assist you with fighting for the best possible settlement permitted under the law. Here is how a Venice, Florida insurance claim denial lawyer at Smith & Vanture may be able to help you:

- We can help you properly document your losses. It is your responsibility to properly document your losses after a storm or other disaster that results in damage to your home. You may not be able to count on your insurance adjuster to identify all damages. Your insurance adjuster will generally investigate your claim based on the damages you document in your proof of loss form, or from photos or videos you submit. If you miss damages, you might not receive money to pay for these repairs, or if you close your claim too soon, you might find yourself on the hook for paying for repairs you didn’t catch early in the investigation. An insurance claim denial lawyer in Venice, Florida at Smith & Vanture can connect you with a private insurance adjuster or review the losses you documented on your proof of loss forms to see if you missed anything. A private insurance adjuster can fully investigate the damages to your home, identify the source of damages, and correct any errors your insurance company’s adjuster might have made. Sometimes homeowners may not have a full knowledge of what their policy covers. For example, if you had to live in a hotel because your home was uninhabitable, if you had to purchase meals out because you didn’t have a kitchen or had to buy new clothes because your clothes were lost in a storm, your homeowner’s insurance policy may be able to reimburse you for these losses. Smith & Vanture is an insurance claim denial law firm in Venice, Florida that understands the claim and investigation process. We can review the proof of loss forms you submitted, catch any errors, and help you properly identify and submit proof to support your claim.

- We can help you properly calculate depreciation. While there are many different types of homeowner’s insurance policies, there are two main factors that differentiate standard homeowner’s insurance policies. Some polices are replacement cost policies, which will pay you the full amount required to replace or repair losses or damaged items in your home. With a replacement cost policy, if your roof is damaged and needs to be repaired, your insurance company will pay the costs to repair your roof, minus your deductible. If your computer or television or furniture was damaged in a hurricane, for example, replacement cost insurance will reimburse you for whatever it cost to buy similar models of these items new. Yet, if you have actual cash value insurance, your insurance company will calculate depreciation when determining the value of your settlement. A newer roof will be worth more than an older roof. Your insurance company will consider years of expected use when determining what percentage of a roof replacement to pay for. You’ll be reimbursed for older items in your home that need to be replaced based on how much you would be expected to pay for a used item. When it comes to valuing depreciation, many factors can affect what figure your insurance adjuster arrives at. After all, the blue book value of a car may reflect the actual value of a used car in some places, but in other places the same car may still sell for more. When it comes to calculating depreciation, it might help you have a homeowner’s insurance claim denial lawyer in Venice, Florida at Smith & Vanture on your side. Our insurance claim denial lawyers in Venice, Florida can review the settlement your insurance company is offering, look at the actual cash value to replace items in your area, and fight to help you get the best possible settlement permitted under the law.

- We can help you understand exclusions and ensure that exclusions aren’t being improperly applied. Most standard homeowner’s insurance policies exclude flood damage but cover wind-driven water damage. Claims can get complicated when a home is damaged due to flooding and wind-driven rain. Differentiating between covered and uncovered damage can be challenging. A homeowner’s insurance claim denial lawyer in Venice, Florida at Smith & Vanture may be able to help you get your damages independently investigated by a private adjuster, help you understand the fine print of your policy (some policies exclude all water damage if flooding was a factor), and fight to help you get the settlement you may deserve under the law.

- We can fight delays. Under Florida’s homeowner’s insurance claim bill of rights, insurance companies must meet strict deadlines when settling a claim. For example, the undisputed portion of your claim must be paid within 90 days of you submitting documentation, and you may be able to request interest payments for any delays beyond these deadlines. In the past, insurance companies wrongfully delayed claims hoping that individuals would accept the first settlement they were offered. Some homeowners even gave up on trying to get a settlement. The Venice, Florida homeowner’s insurance claim denial lawyer at Smith & Vanture may be able to help you receive the settlement you may deserve under the law. We can fight delays, hold insurance companies accountable, and help you get the settlement you may deserve.

- We can fight insurance bad faith. Insurance companies have an obligation to honor their contacts and pay your claim in a timely manner. Yet sometimes insurance adjusters may wrongly represent what is and isn’t covered by your policy, might wrongfully deny your claim, or may fail to properly investigate your claim. If you believe your insurance company acted in bad faith, reach out to the Venice, Florida homeowner’s insurance claim denial lawyers at Smith & Vanture today. We are here to help.

If your insurance claim was denied, underpaid, or delayed, you have the right to appeal the denial or underpayment. Sometimes submitting proper documentation or hiring a homeowner’s insurance claim denial lawyer in Venice, Florida can help you settle your claim, so you can begin to focus on what matters—rebuilding. If you think your claim was wrongly denied or underpaid, reach out to the Venice, Florida homeowner’s insurance claim denial lawyers at Smith & Vanture today.

Let Our Insurance Claims Denial Lawyers in Venice, Florida Help You

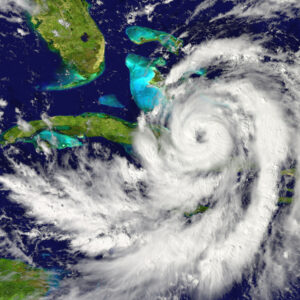

Huge hurricane approaching Florida in America

If your home needs to be completely rebuilt after a hurricane or other serious disaster, the insurance claim denial lawyers in Venice, Florida may be able to help you. Rebuilding after a storm can be a complicated process. When a home has been completely damaged by a storm, homeowners can expect to receive three different checks from their insurance company. One check will be paid to cover living expenses if you cannot live in your home while repairs are made, the second check will be paid for damage to your home, and the third will be paid to cover the cost to replace items damaged in your home during the storm. If you have replacement cost insurance, you might receive your settlement for replacing items damaged in your home in two stages. First, you’ll receive a cash value check for items lost, and only after you submit receipts of replaced items will you receive a check to cover the difference.

Rebuilding after a storm can be challenging. Contractors may be overwhelmed with work. The cost of labor and materials may be higher due to increased demand. Some insurance policies will cover these inflationary costs and others might not. Rebuilding can also be more expensive than rebuilding your home from scratch, especially if you need to remove debris and hire contractors quickly to rebuild. When building a new home, most people have time to find the best costs and builders. In the aftermath of a storm, most companies are overwhelmed with requests and prices can be higher.

Many homeowners who must rebuild find themselves having to pay some costs out of pocket, and this is to be expected if you have a high deductible, have cash value insurance (that considers depreciation), or if your home was damaged due to flooding or other excluded causes. But if you find that the settlement insurance adjusters are offering is significantly lower than the cost of repairs or what you expected, you may have the right to fight back or appeal your denied claim. Reach out to the insurance claim denial lawyers in Venice, Florida at Smith & Vanture today.

Hurricane Damage Lawyers in Venice, Florida

The hurricane damage lawyers in Venice, Florida at Smith & Vanture may be able to help you if your hurricane damage claim has been delayed, denied, or underpaid. In the aftermath of a hurricane, insurance companies might be overwhelmed with many people making claims at once. This is still no excuse for a delayed or wrongfully denied claim. Insurance companies have a responsibility to properly investigate claims and meet deadlines provided by the law. If you have filed a homeowner’s insurance claim and it was denied, delayed, or underpaid, you have rights. Reach out to the hurricane damage lawyers in Venice, Florida at Smith & Vanture. Our lawyers can review your losses, read through your policy, and fight to help you get the claim you may deserve.

Hurricane Damage Insurance Claims Lawyers in Venice, Florida

In the aftermath of a hurricane, you and your family might have experienced extensive losses. Your home may need to be completely rebuilt, or your roof might have been damaged, or items in your home may have been damaged and may need to be replaced. The hurricane damage insurance claims lawyers in Venice, Florida at Smith & Vanture may be able to help you receive the claim you might deserve under the law. We can review your losses, estimate the value of your damages, or hire experts to help you estimate damages, and fight insurance companies and adjusters either inside or outside court to help you get the settlement you may deserve under the law. Contact our Venice, Florida hurricane damage insurance lawyers today.